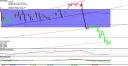

I saw some downward movement near the Asian open and thought I’d get a quick 15 to 20 pips. I entered a short trade on the EURUSD with a 20 PIP target and 10 PIP SL. The trade setup worked, however, I was leaving so increased my target and the original target was hit, but then the pair reversed. I was near the session high and bought in again with a 7 PIP additional risk. Trade is still open as of 12:15 a.m. but slowly creeping up. In retrospect, too slow of a market to enter this type of a trade. Results to follow. Aggressive target is now just above the 5 min. 800 which would give about 40 PIPS.

Update morning of 22 July 2008

This trade closed out once last night on a move just above my SL. Just before I went to bed, it started going back in my direction and I re-entered with a higher SL, and changed the goals to just above the 800 on the 5 min. which was also about the 62 on the 1 hour. I like both of these types of setups and this was a 2fer.

I am a bit bummed this morning (I’ll get over it). The trade worked out exactly as I had hoped. So was I wrong about the trade? Nope, just poor execution and that nasty need to sleep affected the outcome. Actually it even ran past the 62 and 800 (5min) at about 7:00 this a.m. The only problem is somewhere around the 5:30 to 6:00 hour my SL was touched and the trade immediately reversed.

So – what have I learned? Sometimes stops happen. I was overleveraged a bit so although my SL was above the trendline on the 60M, it was a bit tighter than maybe it should have been. I should have had a higher SL using the 60 minute frame and given myself more room to ride this one out. It was not a bad decision to limit losses, it justis frustrating when you are so close and your SL is just a fw pips too close to the reversal point. Next time maybe I’ll use less leverage…

Here are the final charts on the now closed trade: